What is ROI (Return on Investment), and how to present it to customers?

The ROI metric or ROI figure is used by investors to evaluate their investments and judge if they are profitable. How to calculate ROI and present it to customers during a sales meeting? Read our article and expand your knowledge.

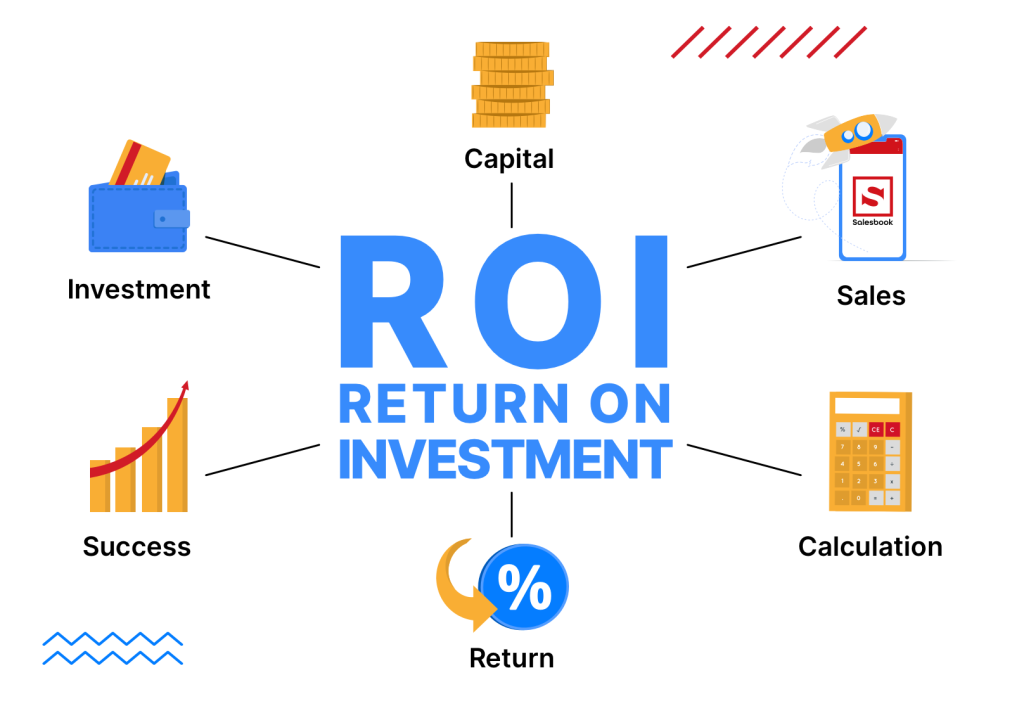

What is ROI?

The ROI metric or ROI figure is used by companies to evaluate if engaging in a particular investment is profitable compared to others. ROI calculations can be used to assess the profitability of IT projects, marketing campaigns, or even social campaigns.

Every company generates revenue and bears the costs related to its business. You cannot take only the initial cost of the investment into account. There are also transaction costs, taxes, maintenance costs, and other expenditures.

If you want to evaluate the profitability of a given investment and whether your sales strategy is successful, you can check it by calculating ROI. Thanks to this, you will know to what extent the invested capital turns into a net profit, and what your return on investment is.

However, you can calculate ROI not only in relation to a particular investment but also to a whole business and its costs. It does not depend on the size of your company or the type of business you run.

You should remember that an ROI calculation is ideal to obtain the exact return on investment. It does not include the profit fluctuations in different seasons of the year.

So, it is wise to know how the mechanism of calculating ROI works. It can be useful not only while sales reporting, but also in various situations when you want to check the efficiency of investing capital in a given venture.

The high ROI can be a decisive argument during a sales meeting on the condition that sales reps understand how to calculate ROI. Let us start from the beginning.

ROI and the accrual basis of accounting

Calculating ROI is related to the accrual basis of accounting. It assumes that the value of money is stable, and the profit earned from an investment is calculated by using that method.

The accrual basis of accounting provides a complete view of a situation in a company because it includes accounts payable and accounts receivable. It records the revenue with the expectation that money for a product or service will be paid in the future.

Sounds complicated? Everything will be clear if you see the ROI formula in the next paragraph.

How to calculate return on investment (ROI)?

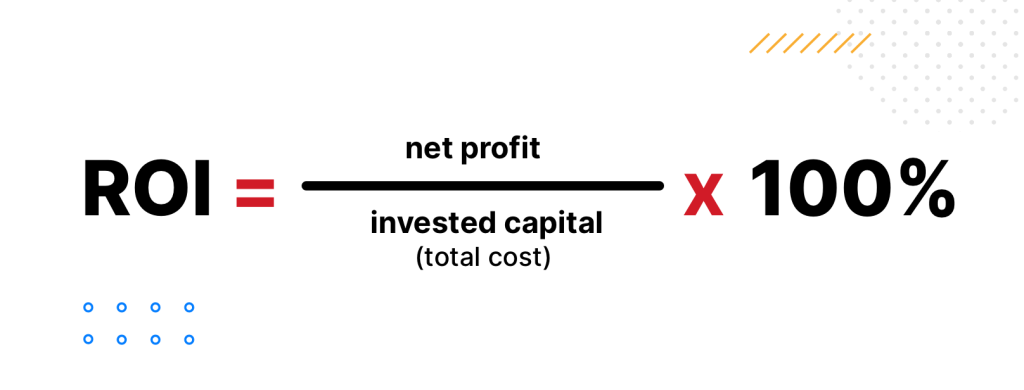

If you want to calculate ROI, you can use the ROI formula calculation. There are various methods to measure ROI. We will present the most common ROI equation. The net income divided by the cost of an investment is the most frequently used ratio.

The ROI formula:

ROI = net income : invested capital (present value = cost of an investment)

- the net profit is revenue minus the costs of production

- the capital means the total cost incurred to make a profit

Example: Therevenue is $800 and costs are $500 which means that the net profit is $300.

$300 : $500 = 0,6

You can leave the ROI metric that way or present its value in percentage. In that case, you should multiply it by 100%.

0,6 x 100% = 60%

It means that the ROI of this investment is 60%. It is not so difficult to calculate this performance measure.

The ROI metric can be helpful if you want to calculate all costs incurred by the whole business. In such a situation, you need to divide the net income by the total assets used by a company to make a profit.

How to interpret ROI?

The rule is simple – the higher ROI you get, the more profitable the investment is. In other words, if the investment’s ROI is positive, it deserves your attention. However, ROI is not always positive.

It is possible that you receive a negative ROI during ROI calculations. It would mean that the investment was not profitable.

The calculation and its interpretation can indicate alarming trends in your business and help separate high-performing investments from low-performing investments.

However, can we even talk about something called a good ROI? According to conventional wisdom and Forbes magazine, an annual ROI of approximately 7% is regarded as a good ROI, when we talk, for example, about an investment in stocks.

“Just keep in mind that ROI is only as good as the numbers you feed into your calculation, and ROI cannot eliminate risk or uncertainty. When you use ROI to decide on future investments, you still need to factor in the risk that your projections of net profits can be too optimistic or even too pessimistic. And, as with all investments, historical performance is no guarantee of future success” – write Benjamin Curry and Emily Guy Birken in their article and ROI in Forbes.

What else you should know? Sometimes ROI is compared to WACC, the Weighted Average Cost of Capital. If ROI equals WACC, the investment is profitable. If ROI is lower than WACC, an investor should withdraw their money and make informed decisions.

However, interpreting ROI, you should be aware of some factors influencing your conclusions. A higher ROI number does not have to mean a better choice. Let us assume that you want to compare two different investments. They both have the same ROI of 60%. However, the first investment needs two years to produce this result. The second investment needs 4 years to be completed. Annualized ROI included in calculations would help avoid these problems.

This example shows that the investor must compare two investments in relation to the same time.

Why is it worth calculating ROI in sales?

Nowadays, customers struggle to spend their money and think twice before doing that. Sales teams must be aware of that hesitation and prepare a solid argumentation to convince clients.

If customers are about to spend their money, they need to be sure that the return on investment (ROI) will be at a high level. Sales reps working in sales teams should know the advantages of calculating ROI and presenting them to customers.

Why is ROI important as a sales argument?

- Every sales team is familiar with a document known as a sales report or sales analysis report. It includes data about sales activities and summarizes them. However, the ROI figure does not have to be used only as a key performance indicator in daily sales reports, weekly sales reports, or monthly sales reports.Hard sales data, exact numbers, all money required for an investment, and net profits – this information is very important to customers and appeals to their imagination. The higher ROI will for sure convince your customer to leave their money in your company.

- The ROI metric is credible. This means that you are a trustworthy sales rep if you use hard sales data and provide a sales analysis report about similar transactions.

- You present different options to your customers and indicate which one investment will bring them more money. You make ROI calculations, and every metric is confirmed by the exact number.

- If someone is experienced in sales reporting, it is not difficult for them to calculate the return on investment (ROI).

However, there is still one factor that needs to be taken into account. Even if you have prepared a lot of sales reports, you may not know how to show ROI calculations to customers. Why is it good to do that, and what for?

Present ROI calculation graphically

As we have said, to calculate return on investment (ROI), you divide the sum earned from an investment (the net profit) by the cost of the investment. Some people believe that it is almost impossible to depict numbers and indicators in an attractive way because it is too complicated and demanding.

However, by using different colors, eye-catching graphs, and modern technology, you can draw your customer’s attention and persuade them to listen to your arguments.

What are the advantages of presenting ROI graphically?

- First of all, you are remembered by your customer. According to different psychological sources, 70 to 93% of all human communication is non-verbal communication. Moreover, 90% of the information transmitted to the brain is visual information.People are able to remember 2000 pictures with 90% accuracy within several days. It is possible even if they saw pictures for a short period of time.

- If you present ROI graphically, you can show your customer several options, and they all look visually attractive.

- By choosing appropriate colors and interesting graphs, you talk about difficult financial investments and topics. Moreover, you can present everything which can help you convince your client. The extra financial value, the current value of an investment, or the total cost of a business venture.

- You engage your customer in a sales meeting and conversation – graphs, pictures, and colorful calculations make the meeting more interactive. Furthermore, your customer does not have to calculate ROI or imagine the profitability of an investment. A modern app does it all and helps a sales rep during a meeting.

- It is easier to remember the information grouped in similar criteria and visualized in a graph. If you create reports and rankings, your customer does not have to analyze data on their own.

We have already mentioned the significance of a visual language on our blog. Remember that if use graphs and visualization during a presentation, so your customer does not have to stay focused all the time.

It is easier to remember pictures and graphs instead of long texts. Your sales team will be more effective if you focus on that, instead of showing the same data tables in Excel.

How to present and calculate ROI with Salesbook?

Salesbook is an app created for sales reps that not only provides them with professional sales reports, but also supports them in sales meetings. It depends on you what kind of sales materials you put inside the app.

You can be certain that with Salesbook every analysis will be easy and persuade your customer to choose your offer.

Get to know the calculator of customers’ needs

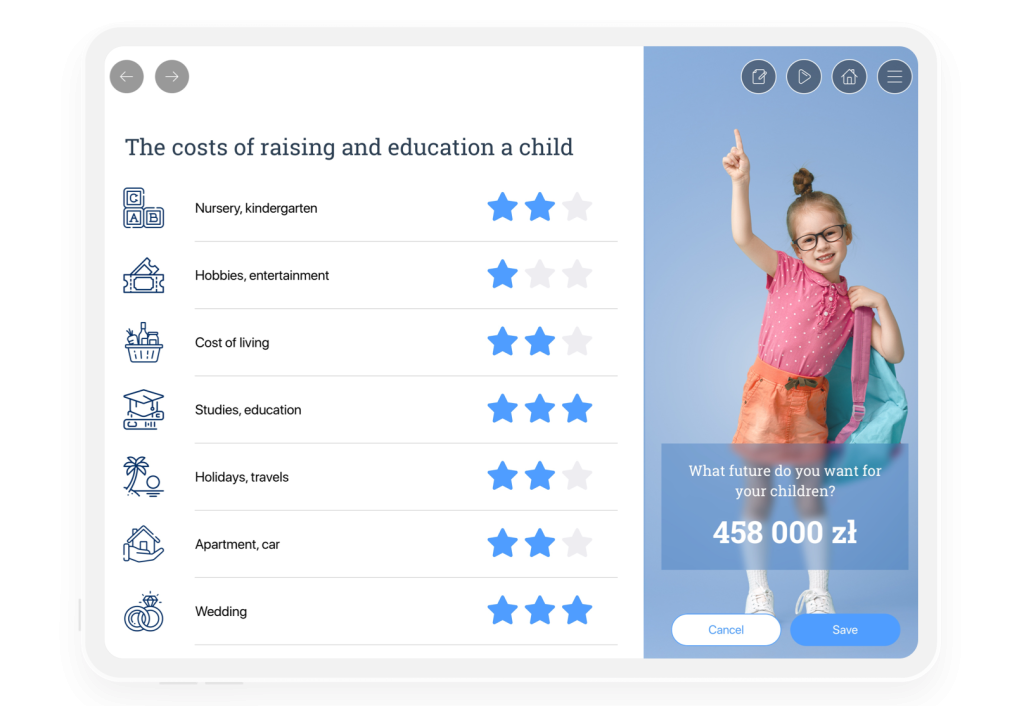

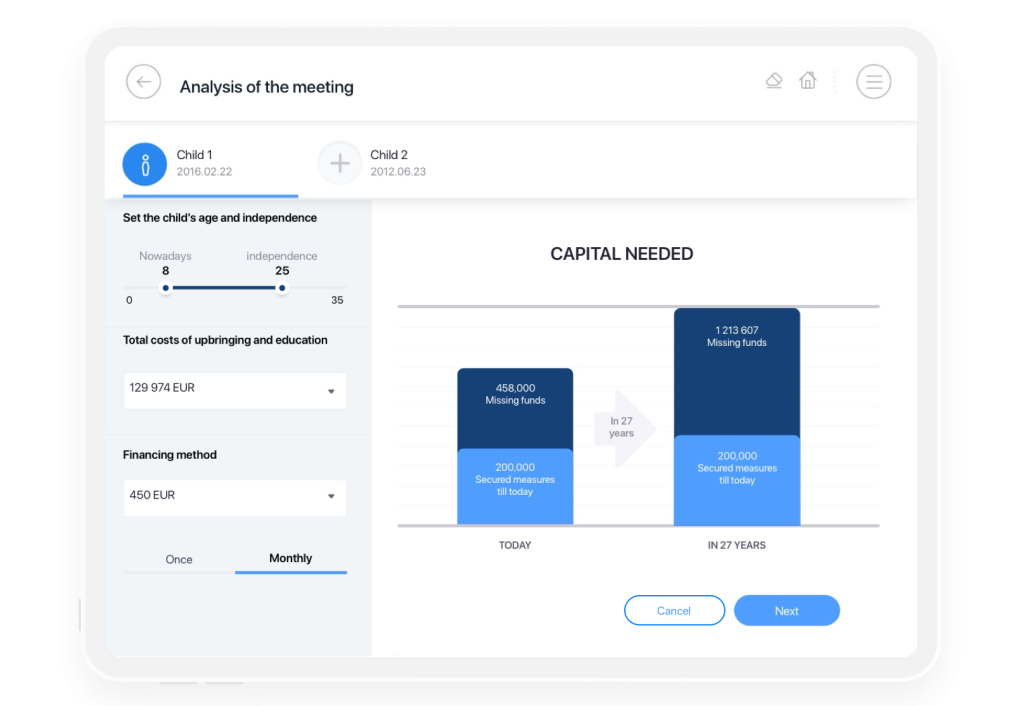

The calculator from Salesbook is a versatile tool that can be tailored to your needs. Moreover, you can use it to get to know your customer’s expectations. Thanks to the calculator, you can personalize your offer and be more persuasive.

Depending on your business and its specifics, you can define different factors important to your customers. For example, the total investment cost, additional financial sources, tariff plan, or own funds of a customer. Salesbook will do the necessary calculation for you.

The app can compare the monthly payments of your customer in relation to the chosen option.

Using the calculator, you do not waste your time by making calculations on your own. Salesbook will calculate ROI for you and present it to your customer. It will also show you data about the first investment, the total cost of investments, and net profits in relation to years. You will see if an investment returns or not.

Do you know that using contrasting data affects your customers? They remember such information faster. Use graphs and visualizations to be more effective in sales.

Summary

You do not have to tell stories about achieving great goals and showing data tables in Excel to your customers. Salesbook will help you analyze sales data and present it to clients in an attractive way. Thanks to the app, talking about ROI with customers will not be difficult anymore.

Do you want to try Salesbook?

Check how Salesbook can help you in practice. Try our free demo.

Table of Contents